1. Be an FBI Interrogator.

I often hear, “I’ve spoken to 50 investors. They said they want to see more data/proof”. And I go, “What data/proof do they want to see specifically? Did you ask them? Did they tell you?”

You have to really push for answers here. “I need to see more data/proof” means absolutely nothing! When they say something like that, interrogate them like hell! And I don’t mean confront them; I mean genuinely ask questions to understand what they mean.

“What is it exactly that you’d like to see? What data? What progress?”

Be open and direct, “Listen, how do I make you go WOW next time I reach out to tell you about our progress?”

“I’m sure you’ve spoken to people who’re building in the same area. What—if accomplished—would make us really stand out from everybody else?”

“What do you want us to derisk next?”

Don’t hesitate to ask these questions. The quality of your questions, the straightforward approach, and your perseverance… are all things investors want to see in you.

Then, investors will give you some “first-level” information. At that point, you have to “coach them” further, i.e. help them think through things to see more clearly what would make a difference and why. It may not be clear to them right away. Ask good questions.

“Why do you think this is important? Why would this increase your confidence in our technology?”

“Let’s suppose we’ve proved that. Why are things now easier? What comes next?”

Help them to slow down and reflect. Fill in the gaps for them.

When they’re finished, don’t rush to say “thank you”. Playback whatever they said and confirm understanding:

“Okay, let’s see if I got this right. What I’m hearing you say is that you want to see x, y, z because… is that correct?”

“Yes, that’s right”. Mission accomplished. You got what you needed.

Now imagine the trust you build with an investor when you go back to them after 3 months and say, “Hey, here’s the progress you wanted to see.” (Well, then they’ll ask for something else but that’s fine!)

Now… you don’t do your homework or ask questions to make investors feel important or please them. Investors are closer to the market than you, they do due diligence on hundreds of companies like yours, they speak to pharma… Your job is to “steal” their market intelligence.

Oh, and the same applies to pharma, i.e. your buyers. They’ll give you their shopping list, they’ll tell you what they need from you, where they’ve struggled and how you can help.

Your job is to collect market insight as early as possible from both investors and pharma.

This approach has multiple benefits:

• you build the relationships (biotech is a relationship business)

• you pressure test your assumptions

• you learn

• you derisk the market

2. Perception is reality (it applies to investors too).

Investors love $$$—and their job is to pick the winners who will generate the biggest returns for their limited partners—but they’re into this (especially in life sciences) because they also want to have an impact.

Is this true for every investor? No. This is simply what “I choose to believe”.

And I do so because, first, I’ve met people like that, and second, this is what serves me to believe.

Because, by proof of contradiction, how can the belief “there are no good investors out there who are willing to help me” help you and your company?

In the end, how can a belief like that help your state of being when talking to investors?

On the contrary, when you keep looking for the good investors out there because you believe those exist, you’ll definitely see more of them. It works with investors; it works with everything in life!

3. Don’t talk to the investor; talk to the human being.

Investors are human beings. Tell them, “Listen, I care dearly about this bloody thing. I want to get this technology to the patient and save lives…

“If for whatever reason you’re not ready to invest, I understand. All I want is your honest opinion, an insight, something you happen to see more clearly to which I’m blind to. Please tell me what you honestly think so I can get one step closer to my vision”.

People want to help (another thing that’s up to you to believe).

Most investors will pass, but why wouldn’t they do something for you, if you genuinely asked? And the least they can do for you is give you their honest opinion.

When I fell in love with biotech and decided to work only with biotech leaders, I was amazed at how tiny the community is. Everyone knows each other. So, why wouldn’t an investor be nice and helpful to the community?

4. Talk to the scientist in them.

In the life sciences, most of the investors are scientists, PhDs, and postdocs like you! At some point in time, you guys could have been working together in the same lab, on the same thing!

Talk to them scientist to scientist. Speak to what unites both of you. You can even joke with them, “Sometimes I wish I was on the other side!” 🙂

5. Play the Steve Jobs card.

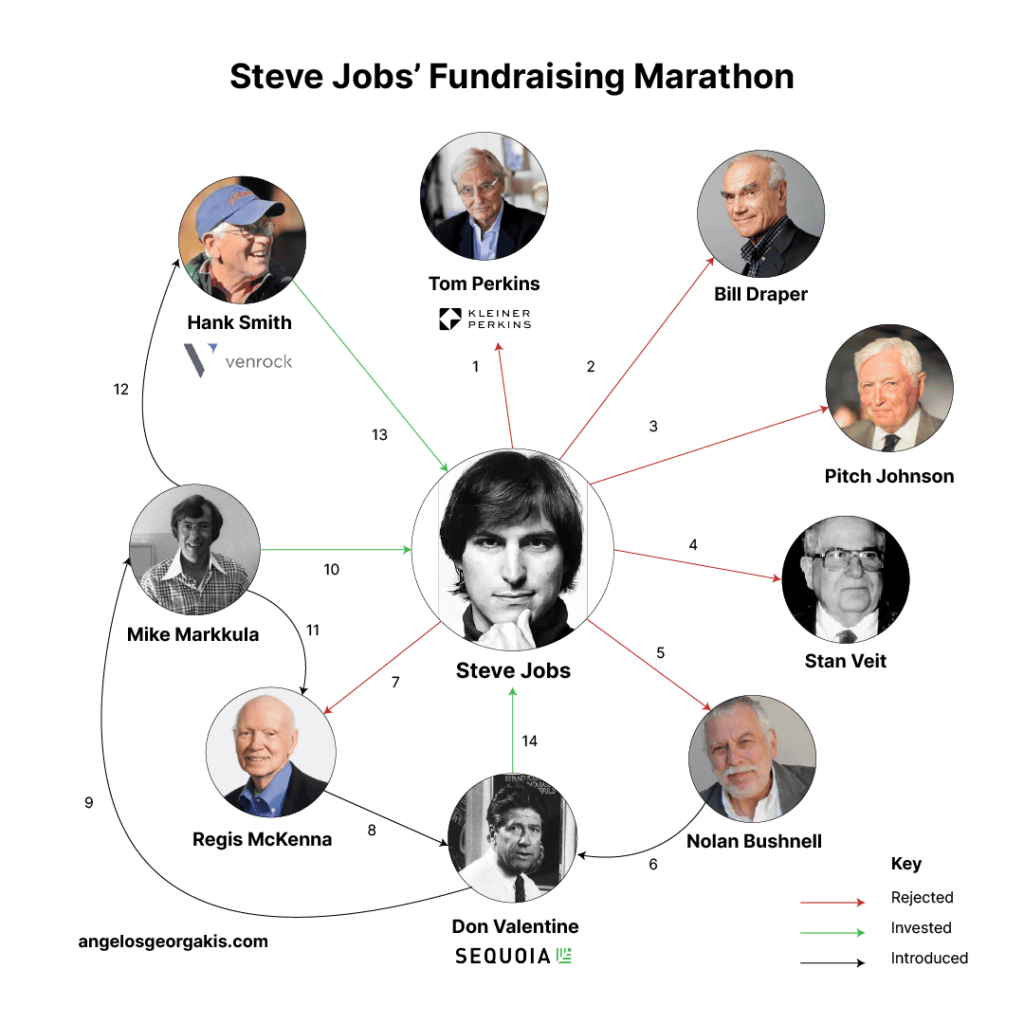

When things get tough, say what Steve Jobs said to Sequoia’s Don Valentine, “Tell me what I have to do to have you finance me”. Don Valentine passed but, to “soften the blow”, he introduced Jobs to the people who eventually… funded him! Another proof here that people want to help…

Can you be so passionate about your vision that you give investors no alternative but to want to help and do something for you?

6. Fundraising is not a one-shot game.

Fundraising is a process in which two parties get to know each other, build a relationship, and develop trust before they decide to work together. Trust takes time and a lot of “touchpoints”.

7. Follow up always with updates.

Don’t just say: “Hey, did you get my email?” Include as many updates and wins as possible. Say, “George Church joined our advisory board! We got another $200K grant. We hired a computational expert.”

And if they don’t always reply, don’t stop. Fire that email to everyone on your list. It doesn’t cost you anything…

8. If you want money, ask for advice. If you want advice, ask for money.

This is particularly true in the current fundraising environment (May 2023). Tell them that you’re not ready to raise yet but you want to build a relationship with them and also ask for their opinion. what’s a better time to build relationships with investors than now?

9. Pitch only to secure the next meeting.

In your first pitch aim for “clear and convincing”, not “detailed and comprehensive”. Give them a “hook”, a shorthand way to remember and describe your company. The VC who heard your pitch now will need to convince their colleagues in the VC firm that you deserve a second meeting. And they’ll probably have sixty seconds to pitch your company in their team meeting.

What do you want them to remember? You have to spend a great deal of time thinking about that take-home message. And that message should be summarised in bullet points both at the beginning and the end of your presentation.

10. Pitch like Eckhart Tolle.

This is probably the best advice I can give you on how to stay motivated during the draining fundraising process. I also call it “conscious” or “mindful pitching”.

As I said earlier, VCs are human beings. And as all human beings, VCs are governed by fear, they get stuck in doubt, they’re stressed, they get greedy, they become emotional, they have limiting beliefs, they make irrational decisions.. They’re anxious about delivering results, they get bored, they’re impatient… And they talk to 15 entrepreneurs a day looking for a needle in a haystack. For all these reasons, don’t just “fire” your pitch.

Remain conscious. Connect with the human being behind the VC.

You’ve scheduled 30 minutes to talk to this person; 30min for you, and 30 min for them. Enjoy these 30 minutes. Be candid, open up, share, and build a relationship with them.

A relationship that can benefit both of you today, in six months, or five years. It’s not just a yes or a no. It’s the beginning of a new relationship. Give yourself and them the gift of slowing down and remaining present in your conversation together.

This person may be your future partner. Enjoy the person in front of you. It’s all you have right now. Enjoy that interaction even if it’s the last time you’ll see each other.

VCs will not invest in you because of your spreadsheets. They throw darts at the wall anyway.

They’ll invest in you because you were the only one from the hundreds they’ve talked to who taught them Eckhart Tolle’s Power of NOW! They’ll invest in you because this chat felt different from all the other chats.

And they may have no clue why it did so! They are often unconscious—and unaware of their decision-making process. They’re going at 100m/h just like you. Slow down both yourself and them—and win. This is leadership; lead yourself into conscious pitching so that you can lead them into conscious listening, and hopefully, conscious investing into your company!